This piece was prepared in collaboration with the Lithuanian Investigative Centre Siena, with the support of the labor activist group Rabochy Ruch, Center for Investigative Journalism of Serbia CINS and CyberPartisans.

This article was developed with the support of Journalismfund Europe.

EU countries freely buy fertilisers from Belarus. According to Eurostat, in the last six months, the EU imported over 7.8 thousand tonnes of urea from Belarus, worth €3.7 million. [*][*] We’re unsure how much was exported from Grodno Azot, the Belarusian sanctioned manufacturer. But we know the company has found a way to disguise the origin of products. The BIC discovered that Grodno Azot is evading sanctions by pretending its urea is from Uzbekistan and using straw companies.

Yury Ravavy, a member of the labor activist group Rabochy Ruсh, informed BIC journalists that Grodno Azot is the only Belarusian enterprise that manufactures carbamide.

“Establishing a production plant like this is extremely costly. Grodno Azot was built over fifty years ago, in Soviet-era Hrodna, and there aren't any matching plants elsewhere in Belarus”.

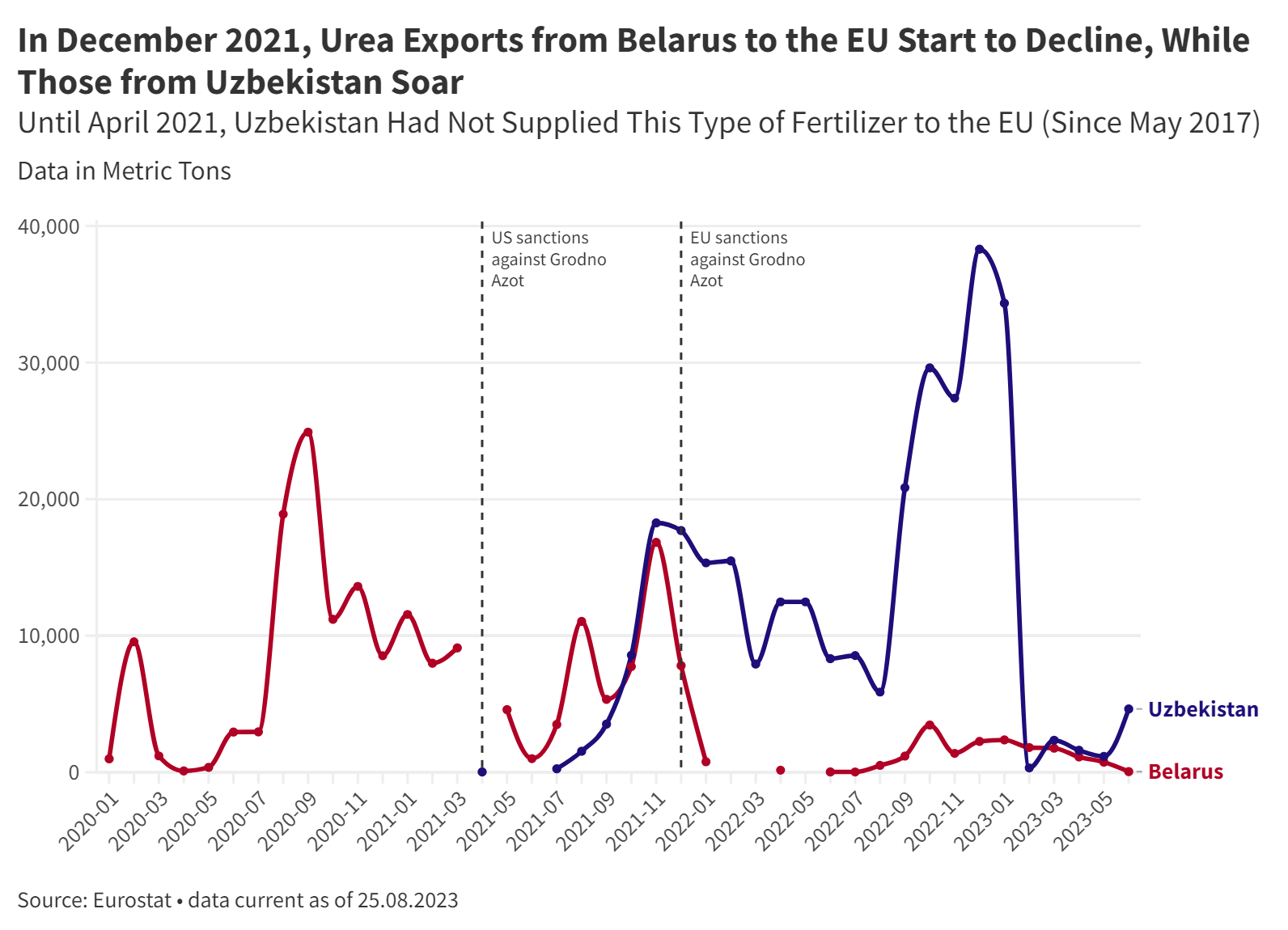

Grodno Azot, one of the largest Belarusian companies, was added to the EU sanctions list in December 2021 for firing employees who took part in protests after the 2020 presidential election. In its decision to impose sanctions, the EU Council described Grodno Azot as “a source of significant income for the Lukashenka regime” and “responsible for repression against civil society”. Since then, data shows the export of urea from Belarus to EU has been declining, while the export from Uzbekistan increased. [*][*]

To Serbia via Uzbekistan

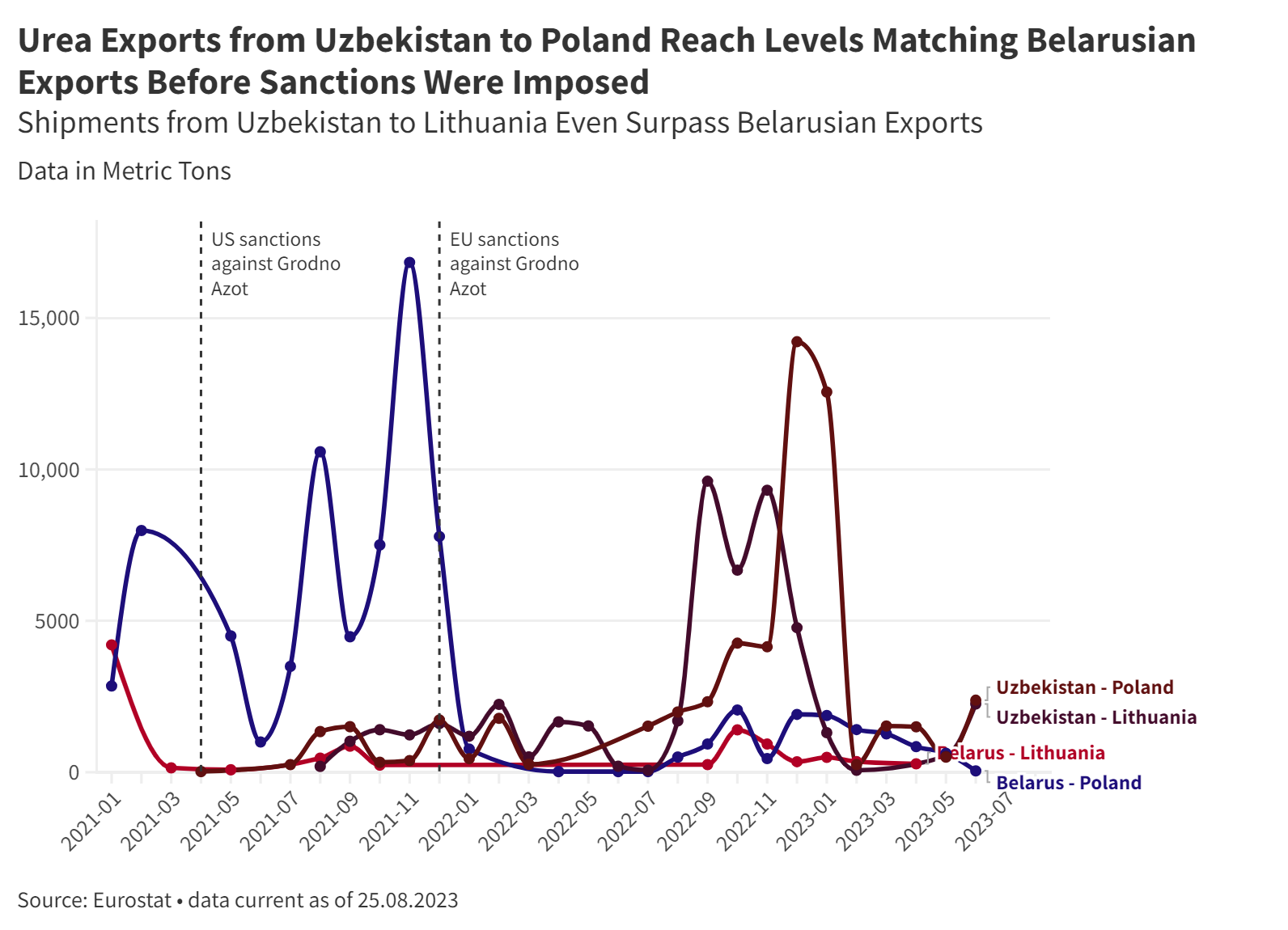

In 2021, when the US and EU imposed sanctions on Grodno Azot, Uzbekistan began exporting urea to the European Union for the first time since May 2017. [*] Over time, the amount supplied from Uzbekistan has reached the same level as from Belarus before the implementation of sanctions. [*] But only on paper. The BIC found that urea from Uzbekistan is of Belarusian origin.

Thanks to the Rabochy Ruсh, we have obtained papers showing Grodno Azot’s evasion of sanctions by misrepresenting its product as Uzbek. We obtained a contract stating the Belarusian state-owned company Grikom sells Belarusian urea to the Uzbek business Wakler Exim. [*][*]

Grikom is one of the straw companies that Grodno Azot used to avoid European sanctions, as revealed in our investigation from February.

In early 2023, members of Rabochy Ruсh intercepted lorries carrying urea from Grodno Azot to the EU. Their sources at that factory have revealed that the organisation is evading sanctions with the assistance of Grikom. The customs delivery note listed Grikom as the sender of nitrogen fertilisers. The Lithuanian customs officers permitted their passage because the EU imposed sanctions on the producer – Grodno Azot – and not on nitrogen fertilisers. Rabochy Ruсh obtained a quality certificate for one Grikom shipment, stating the manufacturer as Grodno Azot. They also obtained a shipping order, which stated that the lorries collected the goods from Grodno Azot and were transporting them to the Serbian company Wakler. Serbia, a potential member of the European Union, has joined EU sanctions against Grodno Azot. After investigating, the Lithuanian authorities stopped trucks carrying goods meant for Wakler. Searches were conducted in three cities, two people were arrested on suspicion of facilitating sanctions evasion, and 3,000 tonnes of urea were seized. From March to June of 2023, Lithuanian Railways refused to allow 1,000 tonnes of mineral and chemical fertilisers from Belarus to enter Lithuania. [*]

Read more in the BIC investigation “How Belarusian fertiliser company ships banned nitrogen to Europe through straw companies”

An annex to a contract clarifies the reason for selling Belarusian urea to Uzbekistan, where has been launched a chemical industry development initiative in 2017, with a plan to invest over $3 billion in the sector, and two years ago, two new plants for producing nitric acid, ammonia, and urea were inaugurated. The document specifies the Serbian company Wakler as the final recipient of Belarusian urea. [*]

Under this 2022 contract, Grikom sold nearly 3,000 tonnes of urea. The Auls railway station, near Grodno Azot, loaded the urea onto wagons according to the acceptance and delivery certificate. For this load, Wakler Exim paid €885,000. [*]

The contract with Wakler Exim was signed by Viktar Rusak, Grikom director at the time.

Before that, he worked for more than 30 years at Grodno Azot. After the BIC investigation in February, Siarhei Ramanchuk, a police colonel who previously led the MIA Security Services Department in the Hrodna Regional Department, replaced Rusak at Grikom. [*][*][*][*]

After our February investigation, the conspirators changed the Uzbek company Wakler Exim name to Dunger, which means ‘fertiliser’ in German. [*]

We contacted Uzbek Dunger (formerly Wakler Exim) and Serbian Wakler DOO for comment, but had not received a response by the time of publication.

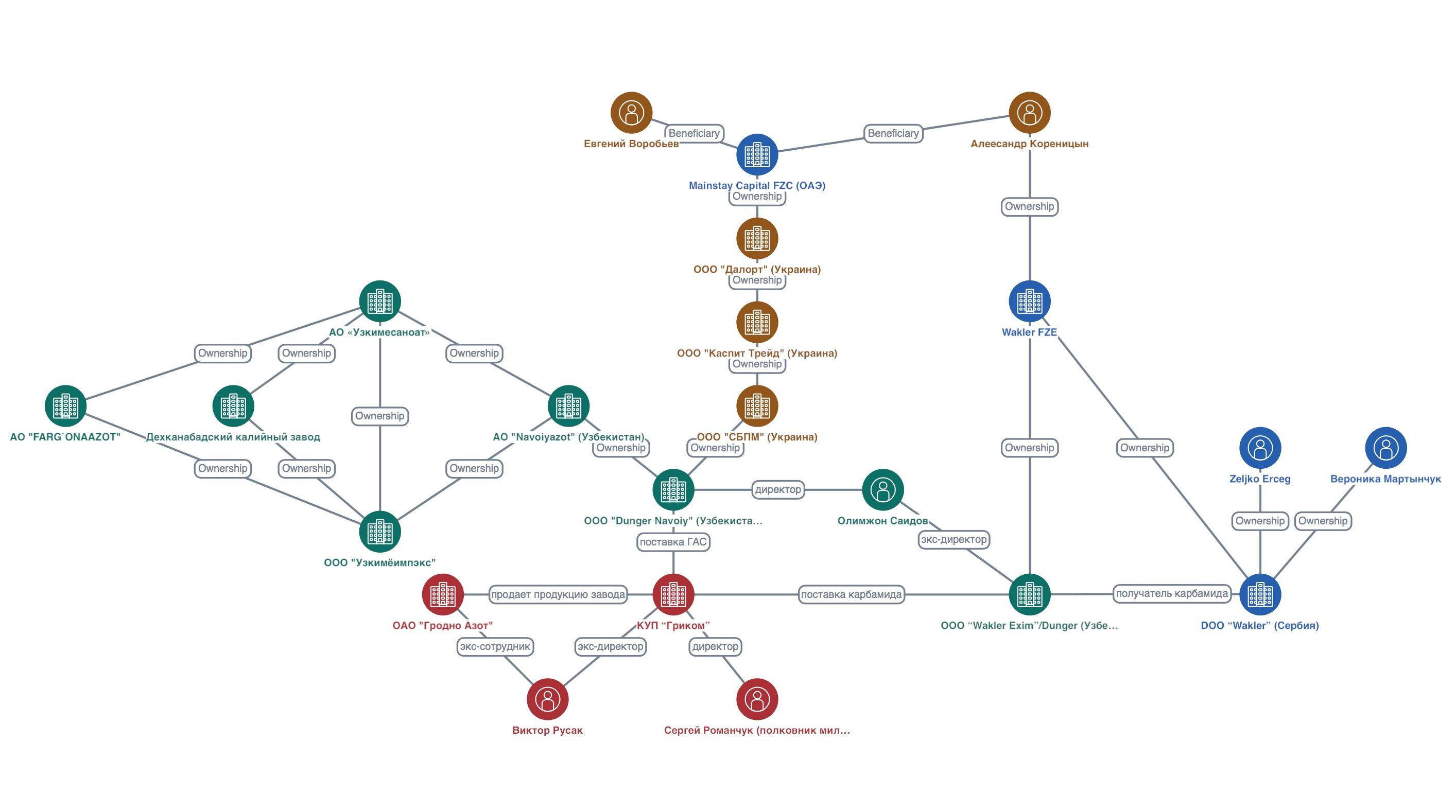

Ukrainian clue trail

BIC investigators found out who is behind the company that helps Grodno Azot to circumvent sanctions. The Uzbek business Dunger (previously Wakler Exim) and the Serbian company Wakler DOO were both registered in spring 2022. The beneficiary of Dunger is Ukrainian businessman Oleksandr Korenitsyn (Ukraine has also imposed sanctions on Grodno Azot). He also owns 45% of Wakler DOO shares. He owns companies or shares through a UAE company, Wakler FZE. [*][*][*[*][*]

The former director of Dunger, Alimjon Saidov, heads firm Dunger Navoiy. [*][*] According to records obtained by Rabochy Ruсh, Dunger Navoiy also received deliveries from Grikom. The transaction involved hydroxylamine sulfate, a commonly used chemical substance in the industry. [*]

About 25% of Dunger Navoiy is owned by Navoiyazot, which is part of Uzkimyosanoat, the state chemical industrial holding company of Uzbekistan. The SBPM company currently holds the remaining shares. SBPM appears to be linked to the Ukrainian businessmen Oleksandr Korenitsyn and his partner Yevgeny Vorobyov, through various Ukrainian companies and the UAE company Mainstay Capital FZC. [*][*][*][*][*][*][*][*]

BIC received a letter from SBPM. The letter states that they, “guided by business ethics and for the sake of protection of the business reputation of our group of companies, ... terminated all contacts with KUP Grikom” after the investigation published by BIC in February.

“Regarding individual transactions of our group with the company Grikom, we inform you that the available documents indicate that the goods supplied are manufactured in the Republic of Belarus, the manufacturer of the goods is KUP Grikom. The goods purchased under these contracts were supplied to the markers of Uzbekistan, Serbia and Turkey, which did not impose sanctions bans on any Belarusian manufacturers and their goods.” [*]

We contacted Belarusian Grikom, Emirati Mainstay Capital FZS, Uzbek Dunger Navoiy and Navoiyazot for comment, but had not received a response by the time of publication. Attempts to establish contact Oleksandr Korenitsyn and Yevgeny Vorobyov has no result.

Nitrogen fertilisers from the potash plant

Other companies that purchase prohibited goods from Belarus do much worse at hiding their origin. The BIC has exposed another smuggling export scheme.

A load of Uzbek urea was purchased by the Lithuanian company Milca Baltija. Its owner is 23-year-old Belarusian Roman Semenenya. [*][*] In Belarus, Semenenya worked as the acting director of the Prommechanika Plant. [*] Prommechanika, which has been declared bankrupt, is infamous for employee grievances over unpaid salaries and production halts. Semenenya also has companies in Poland and Germany. [*][*][*]

The urea delivered to Milca Baltija came from the Uzbek state-owned Dekhkanabat potash plant, according to the customs declaration. But Dekhkanabat does not produce nitrogen fertilisers. [*] In the quality certificate, the term ‘biuret mass fraction’ (referring to an acidic compound of nitrogen elements) has been replaced with ‘burette mass fraction’. A burette is a laboratory apparatus used in quantitative chemical analysis to measure the volume of a liquid or a gas. [*]

According to former employees of “Grodno Azot” from the “Rabochy Ruсh”, such a typo may indicate that the person who filled out the document is not familiar with the production of nitrogen fertilisers. Also, the original delivery note states that the shipment originates from the Belarus city of Lida. [*]

We contacted Milca Baltija and its owner Roman Semenenya, and also Dehkanabad Potash Plant for comment, but had not heard back by the time of publication.

New links in the chain

BIC found another suspicious delivery. In May of 2023, Uzbek urea was transported in Lithuania by the Belarusian company Slavyanski Alyans 2020. This company belongs to Aliaksei Nikitsin, a former worker at the State Control Committee who was convicted and sentenced to prison for manipulations committed with a state enterprise. [*][*][*][*][*][*]

Slavyanski Alyans 2020 sells eggs, dairy and other food products in bulk. The recipient of the Uzbek carbamide shipment was UAB Gerta Baltic in Lithuania. Officially she sells meat. [*]

During a phone call in which a journalist identified as a consulting company staff member, the Slavyanski Alyans 2020 CEO confirmed awareness of the fertiliser supply. He declined to comment on any other related queries. We contacted Slavyanski Alyans 2020 for comment, but had not heard back by the time of publication.

Grodno Azot probably uses other Belarusian companies to export its fertilisers. During the first half of 2023, Poland imported over 6,000 tonnes of urea from Belarus with a value of around €3 million. Lithuania imported 1,000 tonnes worth about 500,000 euros. [*]

A new company, GlobalDeTri, was registered in Belarus in February 2022, two months after the introduction of EU sanctions against Grodno Azot. [*] In February 2023, GlobalDeTri delivered a shipment of a carbamide-ammonium mixture (UAN for short) to Lithuania valued at almost 137,500 euros. Belarus was specified as the country of origin for these goods. [*]

Yury Ravavy states that all ammonia-related production in Belarus occurs solely at Grodno Azot.

“Both the carbamide-ammonia mixture, ammonium nitrate and urea itself are made from ammonia", says the Rabochy Ruсh representative. “And this quality liquid fertiliser is produced in Belarus only by Grodno Azot. It is therefore impossible to mix it with anything else. Grodno Azot makes it exclusively in Belarus”.

Rabochy Ruсh provided us with documents showing that GlobalDeTri bought UAN from Grodno Azot. [*][*] In one of the emails, the company thanked GlobalDeTri for mutually beneficial cooperation in the field of UAN-32 supplies. [*]

We reached out to the director of GlobalDeTri to find out which company produces the UAN they allege to export to countries in the European Union. Pyatrunin stated that his company produces these products independently, and Grodno Azot has nothing to do with it. He said his company buys UAN components from other suppliers.

“We mix ingredients at our plant in Bruzgi, which is near the Poland border. We’ve set up the equipment at the production site and that’s where mixing occurs,” Pyatrunin told BIC.

We also contacted Grodno Azot for comment, but had not received a reply by the time of publication.

Reliable business partners

Assessing the effect of sanctions on Grodno Azot’s operations almost six months after their implementation, CEO Ihar Lyashenka stated:

“The time it takes to deliver goods to customers has gone up, and the geography of our deliveries has changed. However, we still have high-quality products, work closely with our partners for mutual benefit, and rely on their cool head to find new ways to do business in current economic conditions for business.”

Our investigation not only confirms his words. but also reveals some “partners with a cool head”.

The Grodno Azot products were allegedly replaced in Europe by urea from Uzbekistan. But some of these shipments contain Belarusian fertilisers produced by the sanctioned Grodno Azot. The smuggling is done professionally by Grikom and Ukrainian traders who intentionally evade European Union, Serbia, and Ukraine sanctions. So do companies like Milca Baltija which, on paper, buys nitrogen fertilisers from a potash plant. All this is facilitated by state-owned enterprises of Uzbekistan.

Yury Ravavy believes that the lack of oversight means that some of the sanctions turn into a half-measure.

“Over ten former employees of Grodno Azot are now in prison for politically motivated reasons. And if we don't do anything, this will continue. If we close our eyes and allow these sanctions to be circumvented, then the criminal will go unpunished”, says Ravavy. “When the decision is made, we should act on it and go all the way”.

To stop getting around the sanctions, Pavel Latushka, the leader of the National Anti-Crisis Management, thinks extra steps can be taken to restrict the distribution of Grodno Azot goods to Europe. As solutions, he suggests "sanctions on the entire product line" and quotas, such as "only allowing the same amount of goods as before the war."

The sole responsibility for any content supported by the European Media and Information Fund lies with the author(s) and it may not necessarily reflect the positions of the EMIF and the Fund Partners, the Calouste Gulbenkian Foundation and the European University Institute.